E wallet app development cost helps businessmen expand their startup ideas online.

Scan…Enter Pin…Pay!!!

Making payments these days is such an easy task. You don’t have to carry your cash; you don’t need a wallet, just a pin, and everything is done.

“Recently, according to a report, India ranks one in making digital payments, and UPI works excellently. The way it is growing and expanding in various verticals is terrific. A payment gateway is the first choice for most app development companies to integrate for safe and secure payments.”

The world is going cardless and cashless, and e wallet app development agencies are leaving no stone unturned in delivering out-of-the-box unique solutions. Here, you can understand the term e-wallet, how to make e wallet app and its entire development process from scratch to end, its challenges, e wallet app features, and the e wallet app development cost.

- Market Size and Statistics: What Makes Digital Wallet App Development a Great Business Idea?

- Industries That Grow with the Rise of Mobile Wallet Applications

- How Does an eWallet Work?

- Different Payment Methodologies to Consider

- Types of e-Wallet Revenue Models

- Types of Mobile e-Wallet Applications

- Not Just Cashless Go Cardless with Virtual Cards eWallet Applications

- Cross-Border Payment Application to Make Transactions Around the World

- Monetization Model for eWallet Applications

- Key Features of an eWallet App One Can't Miss

- Advance Features – Digital Wallet Mobile App

- Top Challenges That Ewallet Development Companies Face

- Technology Stack for Digital Wallet App Development

- Team Structure Required for e Wallet App Development

- Mobile Wallet Development Team Engagement Model

- E Wallet App Development Cost

- Popular E-Wallet Mobile Apps

- Phew….A Lot of Mind Mapping and Understanding Is Still Left!

- Frequently Asked Questions

Market Size and Statistics: What Makes Digital Wallet App Development a Great Business Idea?

Online payment technology has paved the way for a promising future that e-wallet applications can offer. The market has seen an exponential rise in investors, developers, and users toward accepting and adapting to new trends.

We share here some global data that would reflect why the e wallet app development cost has seen an upward graph.

Recommended Read: Top ways to make Money Transfer App Development Business More Secure

- As per a study, the market for digital wallets will expand at an expected CAGR of 28.2%.

- Regarding numbers, the rise would be from a billion to 7580.1 billion in 2027.

This indicates how open-heartedly the trend is accepted and celebrated around the globe.

- By the end of 2023, the global e-wallet market is expected to rise by 15%, around $2.1 trillion.

Investing in the best Digital Wallet App Development Services would be easier if just numbers could tell the right story. Well, now that you are sure you want to enter the business, let’s have a quick look at the features of the eWallet app.

Industries That Grow with the Rise of Mobile Wallet Applications

eCommerce Industry

Smartphones are a part of our day-to-day lives in the present era. When ordering food, home décor items, apparel, medicines, anything, and everything is delivered in a click. In recent years eCommerce industry has seen great popularity and has bridged the gap between sellers and buyers. With a rise in Digital Wallet App Development, small companies and start-ups have boosted their performance. Because of trends in mobile wallet applications, eCommerce has become easier and payments safer.

On-demand Food and Grocery Delivery

No one is blinded to the rising trends of the on-demand food and grocery delivery industry. With the ease of getting household items delivered in the comforts of drawing rooms, making payments online has seen a rising trend. Integrating e-wallet features with your grocery delivery app development and food delivery app development would make it easier for the customers to make payments and earn better profits.

Taxi Booking Applications

Want to book a cab but don’t have enough cash? Well, no worries. Book your cab and enjoy your ride as almost all taxi booking app development have features of e-wallet integrated. Thus, even if you do not carry enough cash, the payment could easily be made and you would reach your destination as and when needed.

Pay Your Bills Online

This is one of the best mobile wallet features that customers love. Most organizations accept bill payments online and often send reminders too. This makes it easier for the customers to remember their schedules and not miss bill payment dates.

Ticket Booking Apps

When you work to create a wallet like PayTM or Google Pay, you must integrate a ticket booking application with your mobile wallet that would make travel simpler. So, if you want to reach the heights of success, you are just a few steps away.

Now that you have a clear idea of the prospect of digital wallet app development reach the right service provider and get ready to enter the market with a highly engaging and feature ladened app. Before you look further for the e wallet app features and e wallet app development cost, let’s understand how the payments are made.

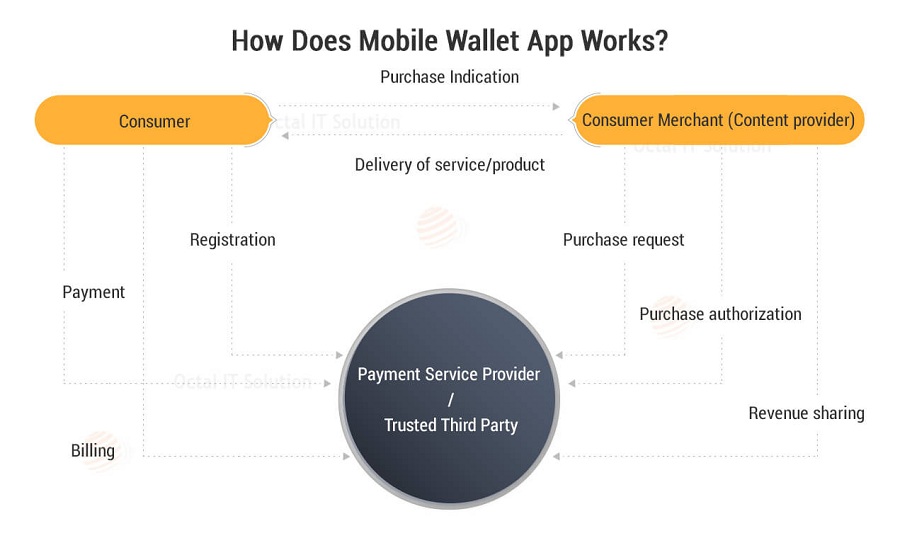

How Does an eWallet Work?

A lot of people who are interested in entering the market with digital wallet apps aren’t sure how to make money from digital payments. We’ll discuss the monetization of digital wallet applications in further sections, here let’s have a look at how e-wallet apps work.

The basic functioning of digital wallets are:

- Create your profile by registering on the application with your contact details (email id and phone number) registered with the bank account.

- Once registered set up a payment pin of 4 or 6 digits. Once you have a payment pin, the registration process is complete and you can make the payments now.

- Search for the payee with their contact number.

- Select the Pay or Request option in the application.

- If you are a business that wants to demand money from the customer go for the request option and if you want to pay someone simply select a payment option.

- Pay the amount with the payment pin and whoosh! You are done.

Transferring money or making payments was never this easy. Along with this simple transaction, you can pay bills, recharge phone numbers, book tickets, make investments, and do a lot more in modern money transfer applications.

Recommended Read: How to Build a Loan App

Different Payment Methodologies to Consider

As you build your own e-wallet application, things become quite complicated for you. You need to find the right money transfer method that would make your app more popular.

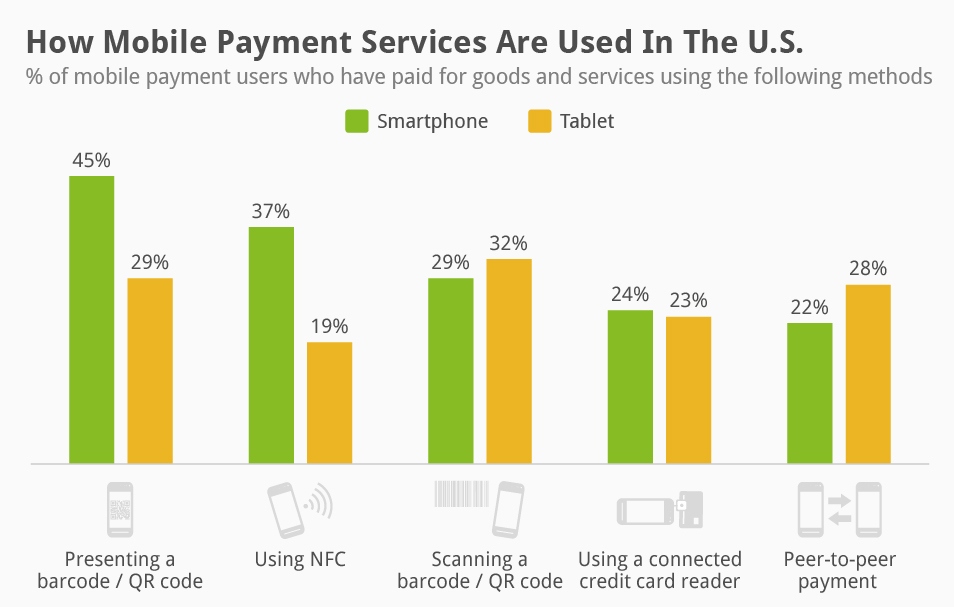

Some of the most popular ways of mobile wallet transactions are:

NFC

According to e Wallet app development service providers, one of the best technologies used for sharing information and transferring funds with a convenient approach is Near Field Communication. Nowadays, most eWallets are using NFC channels for making payments contactless.

Bluetooth and iBeacon

With Bluetooth and iBeacon technology, you can make secure and fast payment transfers. Today’s user community embraces these evolving technologies. Digital Wallet App Development teams can efficiently work on apps using Bluetooth and iBeacon technology.

QR Codes

These payment methods in eWallet Mobile apps are primarily used for making payments. Simply scan the QR code, enter the amount, and be done!

Blockchain

An eWallet mobile app powered by blockchain is one of the evolving payment trends. It is highly secure and immutable. Generally, government organizations and financial institutions use these applications to maintain the secrecy of the payments and amounts transferred.

Recommended Read: Top Blockchain App Development Companies

Payment Apps

Such eWallet Mobile Solutions best suit the business requirements. , businesses can partner with other companies and the local merchant sections and effectively transfer the cash. With the help of personalized mobile apps, moving massive amounts becomes very safe and ensures no third party is involved while making the payments.

POS Payment App

Point-Of-Sale payment applications let vendors receive compensation when the sale is made. Our payment gateway app development team brings a solution that makes transactions easy and clear.

These are the significant ways in which one can make payments online. If you want to create an app like Google Pay, you need to ensure that your app supports all these payment methodologies easily. We build mobile POS systems that make transactions easier for the vendors.

Recommended Read: Money Transfer App Development Cost & Key Features: Build Money

Monty Transfer App

It is not just the payment type that matters but also the kind of mobile wallet that determines the e wallet app development cost breakdown. When you hire mobile app developers, they share different types of mobile e-wallet applications you can choose from for your business model.

With clear instructions and a well-curated application, it becomes easier for the end user to connect with your e wallet application. Another important factor that defines the reflection of your application is the mobile wallet revenue model.

Types of e-Wallet Revenue Models

Experts at our e wallet app development agency believe there could never be a fixed way to generate revenue from your business. As many opportunities you explore, there are more revenue-generating opportunities for any e-wallet business model. Yet, the most popular ones are:

Micro Payments

Applications that are focused on making payments of small amounts fall under this category. This transaction method can either be explored with an independent payment application or an in-app payment methodology. Mostly it works as an in-app payment method, where the merchant demands the amount of the purchase.

Pay Per Use

This is an interesting e wallet business model. Here the usage of the product is metered. The customers would be asked to make payments only for the times when they use the product. This is more like your TV recharges where you pay only for the channels that you want to watch and not everything. Another significant reference is when industry research firms offer pay-per-click or usage offers.

Membership Models

A lot of people often ask us how does e-wallets make money. Well, along with these business models, there are a lot more ways in which the business can make money. In the membership model, the user pays a subscription fee to use the specific service or product unrestricted. This is quite an interesting way to make sure your clients keep coming back to you.

Freemium Version

This is another important and interesting way to engage with customers. Here the owner offers a few services to the users for free and for the rest of the features they would charge. In this case, if the user is fine with the basic functionalities they would rarely ask for more and if there is something missing they have the clear alternative of going for the paid alternative.

Crowdfunding

Crowdfunding is another important topic that you need to take care of. This business model works in a simple way of raising funds from the public. Here the individuals and organizations that like the idea of the product make some contributions to give the product strong financial support and back it with advanced technology.

Recommended Read: Crowdfunding Mobile App Development: Key Features and Cost

These are the basic wallet business models that you can consider for revenue generation. Once when you reach us, our e wallet app development team communicates with you regarding all the points and helps you decide on the right business model with a strong feature set.

Before we talk about the feature set that helps us build a strong solution, let’s see the functions of a digital wallet. It is way beyond simply making transactions.

Types of Mobile e-Wallet Applications

Deciding on e wallet app features would majorly depend on the type of mobile e-wallet application you want to develop. Each of these has its own limitations and advantages. When you struggle with how to start an e-wallet business a quick read here can surely help you through.

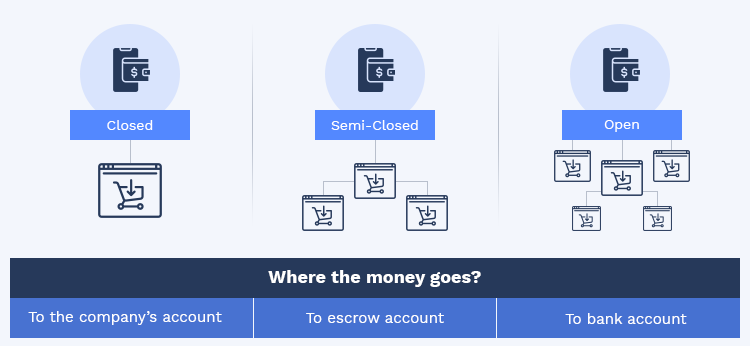

Closed e-Wallets

Well, some apps have in-built payment features, and transactions through these apps cannot be made universally. These organizations are in the business for a long time and often share loyalty points, rewards, and cash backs in the app wallet.

For example, you have a Starbucks wallet where most of the refunds and loyalty points by Starbucks are added. The same goes for other apps like Amazon, Myntra, etc.

Semi-Closed e-Wallets

A step ahead of the closed e-wallet types lies the semi-closed e-wallets. Paytm is quite similar to such apps. These apps are often used to make payments at stores. Their scope is limited and cannot be used at various steps, thus half-closed or semi-closed e-wallets. These applications can also be used to make payments on the same network and other networks.

Open e-Wallets

These are simple and the most popular e-wallet applications that make things easier for people to use. They can be installed over any platform and are compatible with all networks. These have an extensive scope of payment and can handle all types of expenses easily. E wallet app development cost highly depends on the market we explore and the e wallet app features we include.

Cryptocurrency eWallet App

Get an eWallet application that deals in cryptocurrency. Our cryptocurrency wallet development team brings solutions that can be used to make crypto payments globally. We have been offering solutions that are easy to make crypto exchanges without much hassle.

NFT-Based eWallet Applications

We work on solutions that are easy to publish and can help you build a strong presence in the virtual marketplace. With crypto punks, NFT monkeys, and other digital assets gaining popularity, the need for NFT-Based eWallet applications has increased in numbers.

Recommended Read: NFT Marketplace Development Work Model, Key Features & Cost

IoT eWallet App

The applications that leverage the power of the Internet of Things to make seamless payments come under this category. It is generally integrated with wearables and transaction devices.

m eWallet App

These applications are designed and developed only for mobile phones. They let users pay via various methodologies like QR code scanning, Account Transfer, etc. Our e Wallet app development team can build solutions with advanced technology and help you be on top of your business.

BNPL eWallet App

The applications that give users a little time frame to make payments or split payments into installments are Buy Now Pay Later ewallet applications. These applications are gaining popularity because of their flexible payment terms and interest-free installments.

Recommended Read: Buy Now Pay Later App Development: Step-by-Step Guide

Hybrid eWallet App

As the name suggests, these eWallet applications are the ones that are a mix of various eWallet applications that we have discussed above. These applications allow users to get multiple payment options giving them the ease and convenience of working on the solutions.

These are the significant kinds of e-wallet apps that one can consider for their business.

Not Just Cashless Go Cardless with Virtual Cards eWallet Applications

With time changing, Jupiter, Slice, OneCard, and many similar Fintech startups have brought the concept of virtual cards to the arena. These applications let you have a card that behaves like an actual debit/credit card but is available virtually. They let you split your payments in installments, make payments later, auto-recurring payments, etc.

The market is open to such applications, and if you are looking forward to entering the market with a similar solution, partner with the right mobile app development company and see what wonders they can do.

Electronic payment app and virtual cards app are the future of digital payments.

Cross-Border Payment Application to Make Transactions Around the World

If we look into the major challenges of developing and using a digital wallet application, it is the restriction of being used in several countries. But with cross-border ewallet applications, we can overcome this condition. Our cross-border wallet app development team brings to the picture solutions that are easy to use and help you make transactions worldwide. They are integrated with an auto-currency converter and thus can be used to make payments in multiple currencies. We have experience developing global cross-border applications that let users manage things easily. Cross-border Payments app is surely an exciting business opportunity if you want to enter the fintech app market.

Recommended Read: P2P Payment App Development Company

Monetization Model for eWallet Applications

In a market of tremendous inflation, success can not be a sure piece for businesses. It must be a sparkling app idea that will elevate your brand value. Mobile service providers across the world use highly adoptable monetization methods for their development of the app.

Let’s discuss here some of the models.

Commission-Based

Keeping the business working is a necessity for businesses. In the commission-derived model, the authority owner surges a fixed charge to the bank transfers and the user. For example, a user performs a transaction on the platform and pays a small charge to the bank.

Earn by Advertising

In such a model; a similar bank service provider allows them to place their ads on the displaying area of the platform. This allows a large customer base on that platform. This is one of its kind of sources of income to drive the businesses.

E-commerce Enabled

This model welcomes new companies to run their services over the already pitched platform mutually. E-commerce has multiple options for giving back to the marketplace. Due to the more significant presence of overcrowded traffic, it preserves more scope for e-wallet transactions and businesses.

Freemium Solutions

Why not enter the market with a solution that lets users make essential payments for free but charges to use extended features?

This can help you build a strong presence in the market. Your users would be excited to explore the new advanced e wallet app features and willing to pay a little.

Choose any of these monetization models and connect with our experts to get an app that aligns with your business objectives and helps you make profits.

Key Features of an eWallet App One Can’t Miss

User Panel – e-Wallet Mobile App

User Registration

This is the major section of an app; the user can sign in with the social network or email account credentials.

Authorize Bank Account

Users can select the bank details they want to transact. They can register a particular bank account and pay with it instantly.

Add Balance

They can add a certain amount of balance to their account according to the number of transactions to be made.

Check Balance Status

Once all the transactions are made, the users can view their account balance and check all the incoming and outgoing cash flows.

Transfer Cash

Users can transfer the cash amount to the other concerned users by entering their account details, thus, allowing them to make the transactions effective and convenient.

Pay Bills

Users can pay the bills via their registered bank accounts to maintain track of all the cash flows conveniently.

Accept Payments

Users can receive payments as well. Users can securely accept payments by sharing their corresponding account details.

Transaction History

All transactions made by users are recorded and tracked. The user can search for all the dealings with advanced filters from the transaction history.

Invite Friends

Users can also invite their friends to send and receive funds. This way, they can quickly transfer the amount as and when required without asking for account details daily.

Admin Panel – Mobile Wallet

Manage the Users

You can review user profiles and manage them. If there are any suspicious transactions or things don’t feel right you can block or suspend certain accounts.

New Offers

Manage any new offers, referrals, reward points, and other details. The admin can manage various activities around gamification and user-engagement.

Manage the Contacts

The admin manages all the users related to the app, the ones making the payments very often, and all the user retention and acquisition techniques.

Analytics and Reporting

Analyze and manage the details of number of users associated, types of offers most availed, number of transactions incurred, app usability and bounce rates, and all other vital details in form of graphs or pie-charts.

Admin can accordingly validate all the reports and outline certain solutions for augmenting the visibility of the eWallet Mobile App.

Add/Block Features

According to the count of rejected or unauthorized payment processes; the admin can block the users. In the same way, he can also add new user requests depending on the number of users already aligned with the app.

Read More: How to Develop a Blockchain Wallet App

Advance Features – Digital Wallet Mobile App

We share here new e wallet app features that clearly reflect how far you can go with the Digital Wallet App Development process.

Geo-location

This feature is covered with E Wallet App Development cost, and it significantly impacts the visibility and popularity of the app. With the help of GPS, users can locate nearby users and can make the payment by just tapping on the user name. Thus, one need not fill in the payment details again and again, saving time and energy.

Data Synchronization

Now, while discussing the e wallet app features to include during e wallet app development, data synchronization is likely to play an important role. The app is in-sync with your registered email id and mobile number to deliver high-level security and accuracy. Thus one can shake off the struggles of filling long forms to register an account.

Booking Calendar

Users can simply highlight the date on the calendar for recurring payment reminders and recieve a notification for the same on due date. This way, making transactions becomes very easy and keeps the users away from any payment-related headaches. They can even share the calendar with friends to make the entire payment ecosystem effective.

In-app Camera

This comes to great use in QR code scanning. With the help of an In-App camera, users can send the receipt of transactions to other users. One receives an instant confirmation message within an app to validate all fund transfer requests instantly.

Cloud Operations

One can check their transaction history easily with the help of cloud operations. The cloud operation helps augment the quality standards of your app and enables the users to make the transaction faster. It helps to access the data more powerfully and captures high user attention.

Wearable Integration

This is the feature for which users look nowadays. Users can integrate smart wearable devices with their apps and monitor all wrist payments. Our wearable app development team ensures such applications are compatible and accessible with the devices. It adds greatly to user convenience and, at the same time, defines a new approach and trend for making payments with a straightforward and convenient approach.

Tokenization

It works great for improving the security of transactions. It generates a one-time code and hides the information about credit/debit card information from the merchant. Our digital wallet app developers take privacy, confidentiality, and data security seriously and make sure your application fails none of them.

Digital Receipt

Generate a digital receipt for all your transactions. You can share same via phone, email, text, or within an app. One can download the transaction details in PDF format for later references.

Categorization and Portability

Users can conveniently categorize the different transactions and card details. They can easily add money and can share it over both online and offline modes. Our app developers deliver solutions where the application can sync data and check if the payment is for a food delivery app or an ecommerce app and categorize payments accordingly.

Loyalty Program

Offer rewards on every successful referral. Users get loyalty rewards, and at the same time, it helps in increasing the app’s visibility. The right e-wallet app development services will help you be at the top of your game with more user-engagement ideas like gamification.

Audio Box

Our POS App Development team integrates the audio box with the application to make sure vendors and other users don’t struggle with constant rechecking of the applications made.

These features have enabled Digital Wallet Applications to enter the market with unique and innovative solutions that would make it easier to survive the competition.

Top Challenges That Ewallet Development Companies Face

No mobile app development company can deny dealing with security, safety, and confidentiality concerns. When we talk about fintech then the situation gets a little serious. Fintech deals with information about your finances like bank accounts, debit cards, credit cards, and other information. The mobile app development team faces many challenges when developing a highly safe and reliable solution.

Our e-wallet app development team has seen each challenge as an opportunity to develop stronger, better, and more reliable solutions over time.

Let’s talk about some of the most common challenges, their solutions, and the opportunities they bring with them.

Challenge 1: The Right Technology for the Perfect Deliverance

It is complicated to identify and use the right technology to deliver the right solutions. We make sure to deliver solutions that are scalable and future-ready. For such solutions, our team needs to be updated with the technology and use the ones that have a better scope in the future.

Solution: Use Futuristic Technology

Artificial Intelligence and Machine Learning solutions are making it easier for developers around the world to build e-wallet applications that are reliable and technologically advanced. Augmented Reality is another technology that is molding the fintech industry only for the better.

Opportunities

The e-wallet development opportunities here are pretty extensive. When you think of any financial institution and the services it provides, we can bring it all a click away. One can always use advanced AI and ML solutions for security, blockchain for data modulation, AR/VR for verifications, etc.

Challenge 2: The Need for Regulatory Compliance

Mobile wallets and online payment platforms need to have some permission from government jurisdictions before coming into the real picture. This entails customer and financial institution regulations that define their functioning. If there is some major drift in the compliances, then the owner must deal with judicial issues.

Solution: Before You Hire a Development Team Get a Clean Chit

Clear the regulation compliances and understand the terms and conditions before you reach the development team. Although the ewallet application development team at Octal IT Solution is aware of the complaints in most countries around the world, a clear set of instructions would be better.

Opportunities

Regulations and compliances define the ewallet app solutions we work on. One can start with a strong mwallet app development trend where the compliances and regulations are adhered to and help you make a strong presence in the market.

Challenge 3: The Risk of Frauds

It is essential to take care of the frauds and the risks that come with digital wallet app development. There is a general mindset about digital transactions where people assume there is a high risk of fraud, data theft, data leak, hacking, malware attack, etc. Over the years, technology has advanced so much that these things seem no wonder.

Solution: Use Advanced Technology and Stick to Compliance

When discussing secure and safe solutions most digital payment apps these days are GDPR compliant. Not just this, these solutions go through a strict verification process and make use of the technologies like Blockchain and Encrypted messaging to ensure things are reliable and easy to proceed with.

Opportunities

When talking about the risks associated with payment mobile applications, there is a better scope of development. E-wallet app development opportunities are most around making the application credible and reliable. With various development considerations and using advanced encrypted methods for transactions would offer a better future.

Challenge 4: The Mindset of the Customers

This is another reason why money transfer applications and digital payment platforms seem to have a limited scope. The target group, instead of being universal, is the youth. Many people still don’t trust online payment methods as they do not rely on the fact that these are safe. Also, they doubt if the transaction is unsuccessful, they may lose their money.

Solution: Spread Awareness and Guide People

To expand the horizon of the audience group it is important that you tell people about the safety features and understanding of the application. They need to be aware of the credibility and reliability of the solutions. Also, it should be easier to navigate for better and faster transactions.

Opportunities

Although till we talk about finances, security would be an issue. Your e wallet app development agency with advanced technology one can come up with more reliable and credible solutions. Also, a technologically advanced User Interface would make it easier for the technotards to make payments easily thus expanding the domain of e wallet applications.

Challenge 5: The Lack of Trust

When we talk about the challenges related to e wallet development, the lack of trust in the team is one of them. Deal with e wallet development challenges with immense care to ensure that the solution reflects well. If people cannot trust their devices, they aren’t going to keep money in them. They are often scared that if the device is lost, they may lose all their money too.

Solution: Bust the Myths

It is important to deliver an app with advanced security feature. Your marketing team must take care of busting the myths around the e wallet app development and its usage. Over the years, we have been working toward delivering better solutions that would make things easier for all.

Every doubt comes with an exciting opportunity. The risks that ordinary people think are associated with the ewallet application can be declined if developed solutions use some technology where the biometric locking and verification system is used.

With AI And ML solutions, one can develop products that use biometric identification to make transactions. Thus, no two people would be able to access the same account.

These are some of the most common challenges and solutions that our team takes care of. With various opportunities and solutions, it is important that the product that gets into the market is interesting and unique.

Technology Stack for Digital Wallet App Development

The e-wallet app developers work on the projects that make it a point to deliver you great results without compromising the feature set that you have longed for. E wallet app development cost highly depends on the technology stack used.

- Twilio: For Push Notifications

- Nexmo: For SMS, Voice, and Phone Verification

- Braintree & PayPal: For accepting payments

- GWT: For Powerful Programming

- Datastax: For Data Management

- Mandrill: For everything related to emails

- ZBar bar code reader: For scanning the QR code

- Debian: The universal Operating System Database

- MongoDB, Hbase, Cassandra, Postgres, MailChimp Integration

- Cloud Environment: Amazon AWS

- Real-time Analytics: Hadoop, Spark, BigData, Apache Flink, Cisco, IBM

**Note**

Different wallet app development agencies choose different tech stacks and the one discussed here is most reliable and credible.

Team Structure Required for e Wallet App Development

Other than finding the Mobile App Development Company there are some key persons as well that actually undertake the responsibility of developing the app from scratch.

Other than finding the digital wallet app development team there are some key persons as well that undertake the responsibility of developing the app from scratch.

Developers

They are the actual creators of your mobile app and take complete responsibility for crafting just the perfect solution for making your app a clear winner in the cut-throat competition. Of course, the technical team can be composed of Android app developers & iOS App Developers headed by skilled and experienced project managers.

Designers

The UI/UX Design team takes the essence of your app to a whole new level. A beautifully designed app will surely attract users, no doubt how strong it is on behalf of development.

Testers

An app befits your business in case it is true to quality. Thus, the role played by the team of QA experts and testers cannot be undermined. Users abandon an app full of bugs.

Project Manager

Owing to this position, the person must know all the guidelines for engineering an out-of-box eWallet Mobile App. She/he should be able to identify what is best for the client’s business model and must be able to figure out the best possible solutions.

Any credible E-Wallet Mobile App Development Agency would at least include the above-mentioned members in the team. Choose agile methodology for your solution development and make it a point to bring on the screen an experience that reflects your idea. Significantly, the project you want on screen is designed and developed with your review at each point.

Mobile Wallet Development Team Engagement Model

Depending upon the business’s physical location, individuals or operators can select from any of the three engagement models.

- Offshore Engagement is when the operator or entrepreneurs want the project to be completed remotely. You can outsource e wallet app development teams to get a technologically advanced solution designed by keeping marketing trends in mind.

- Onsite Engagement is when the business individuals want the project done on the office premises. So as per the guideline, the required and allocated eWallet Mobile App developers are sent to the office along with the assigned work.

- Hybrid app development is the mix of both and is opted for when the business person wants to compete for the app within a minimum time. During office hours, developers are sent to the office; after that, the team works remotely. Connect with a mobile wallet app development provider that offers you the ease of working with their team as yours.

Choose for yourself an e wallet app development hiring model that fits your business needs and your budget the best.

E Wallet App Development Cost

Most companies charge as per the man-hours they put into developing the app. In regions like North America, for instance, the price is around $150 per hour; in Europe, it is $130 per hour, and the companies situated in Australia charge around $190 per hour.

India is one of the most affordable counties for e-wallet app development at $25 -$80 per hour. E wallet app development cost around $25,000 to $50,000, and apps with extensive e wallet app features, such as Paytm, can cost up to $100,000 to $150,000.

Other than this there are several other factors that define the e wallet app development cost such as

- Features (basic/advanced)

- Experience of the Developers

- Country of the Development Team

- Engagement Model

- Tech stack and a few more.

Popular E-Wallet Mobile Apps

Some of the top e-wallet mobile apps in the market are Paypal, Google Pay, Samsung Pay, Stripe, Amazon Pay, Whatsapp Pay, Phonepe, and many others. Our experts study and research these before they begin e wallet app development for your project.

Google Pay

Google Pay is one of the most popular solutions that lets users add money to their wallets for instant payments. The ease and 2FA make the application a credible place to count money and use it as required without carrying your traditional wallet.

Many businesses that connect with the best fintech app development company or another service provider often ask if they can integrate Gpay payments with their applications, making it one of the most popular online payment platforms.

Amazon Pay

One of the best examples of semi-closed wallets, AmazonPay offers users unique perks. They can get discounts on the total order value, pay bills, and make payments to other AmazonPay users.

Paypal

It is a global cross-border payment solution for costs in a secure way. 51% of businesses trust PayPal for their payments. More than 27M traders’ preferred choice worldwide is Paypal.

Most e-commerce app development companies integrate it into their solutions. Paypal offers secure payment methods for transactions. It also occasionally provides a wallet, debit card attachments, and bank accounts with discounts and rewards.

Venmo

Another online payment application that is gaining popularity in recent days is Venmo. It has a fantastic interface and lets users make payments without any disruptions. We consider Venmo’s look and feel one of the simplest yet most effective in terms of user engagement and adaptability.

PhonePe

Phonepe has one of the largest transaction ecosystem with a user base of 340M+ worldwide. Stakeholders from worldwide trust this platform for its safe and fast payment solutions. Using the application is convenient. Simply enter the 4-digit mpin and Ting! Payment done.

For most e wallet app development agencies, PhonePe is the best inspiration considering its ease and user-interface.

Also Read: Best Fintech Mobile Apps Startup Ideas

So finding the right e-wallet application development partner to help you through the journey, starting with an innovative concept, unique ideation, passion, and tech stack, will drop the e-wallet app development cost and time framework for developing a virtual wallet app by up to 40%.

Phew….A Lot of Mind Mapping and Understanding Is Still Left!

If you embark on the virtual wallet app development journey, this guide surely can be your manual. Another challenge is choosing the right company to help you with a feature-laden solution.

Recommended Read: How to Find the Right Outsourcing App Development Company

Therefore, before embarking on the journey, choose an e wallet app development agency that can understand your business objectives, e wallet app features, e wallet app development costs that helps you to achieve your business goals and reach your audience with an interactive and intuitive solution.